W-8BEN

What is a W-8BEN?

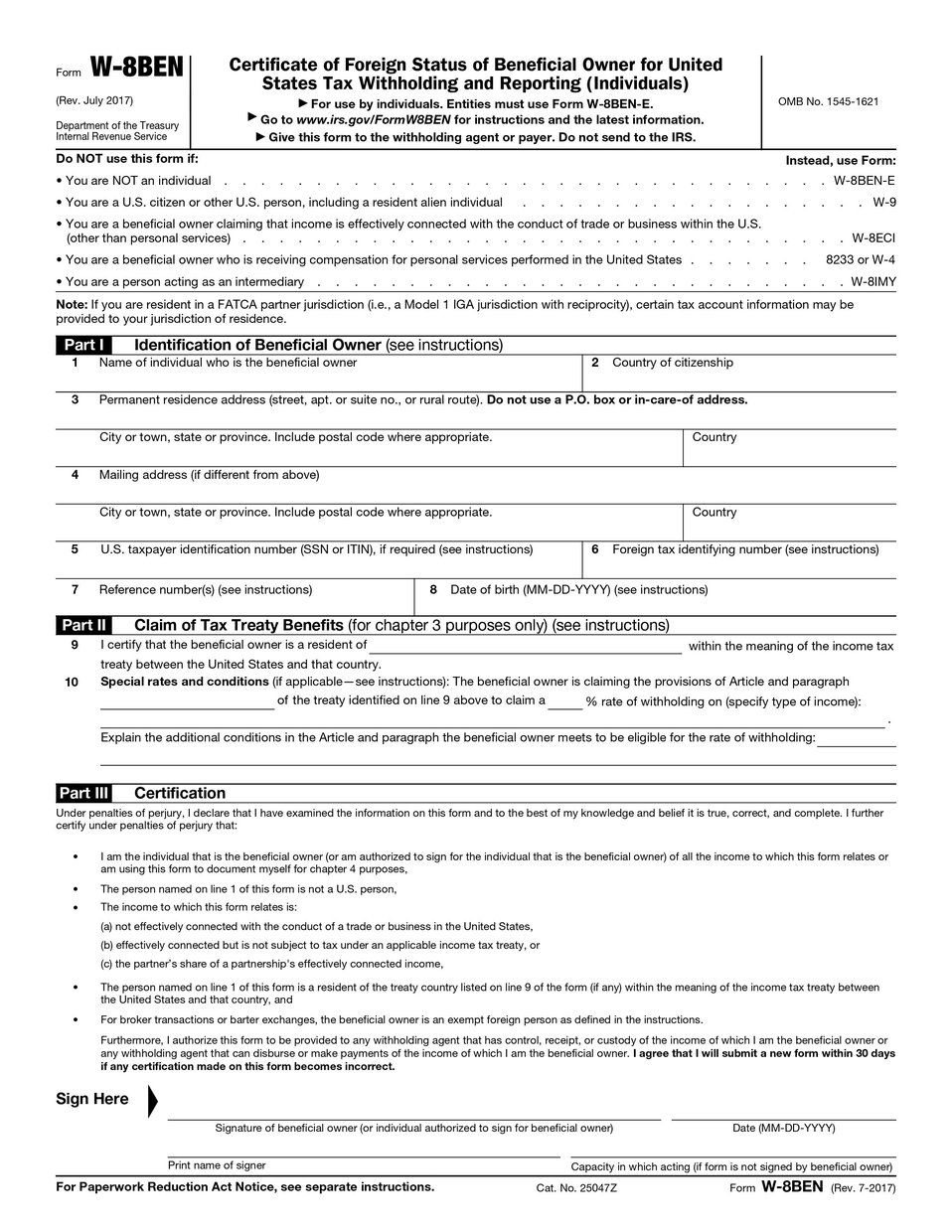

The W-8BEN applies to foreign individuals and sole proprietors who earn money from U.S. sources. Failure to fill out form W-8BEN means the IRS can withhold 30 percent of income earned from U.S. sources. This includes any interest, rents, royalties, and other compensation. You should give Form W-8BEN to the withholding agent or payer if you are not a resident in the US and you are not a citizen of the U.S.

W-8BEN-E

What is a W-8BEN-E?

The W-8BEN-E is also a form required by the Internal Revenue Service (IRS), the United States tax agency. The official document title is Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities).

It is a form that you will receive already completed by the foreign entity, outlining your income. This form has four main functions: to establish non-US status for the company; claim beneficial owner status; claim exemption from, or reduction in, US tax withholding under Chapter 3; and identify the entity’s category under Chapter 4 of the Foreign Account Tax Compliance Act.

How to get started with RemoteTeam

Answer Questions

Our attorneys prepared steps of questions for employees and contractors to fill the necessary information on W-8BEN form.

Sign-Up

Sign-up to the dashboard after filling out your information to send, collect and sign W-8BEN form online.

Collect Your Documents

Get the necessary information from your contractors or your team. Your documents will be stored on RemoteTeam dashboard for further use.

RemoteTeam is built for hiring international contractors and employees

Click to learn more